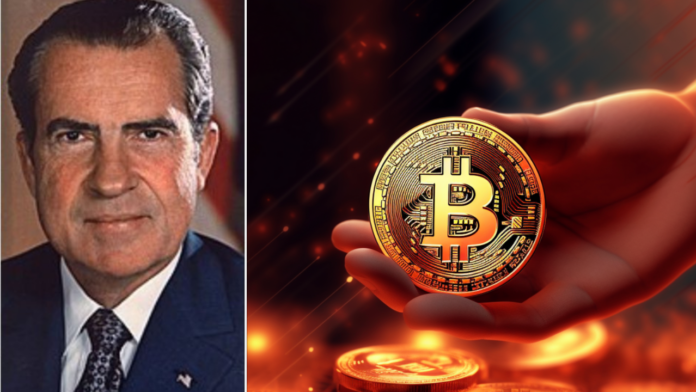

The Dawn of Nixon Shock: A Paradigm Shift in 1971

52 years ago, on a pivotal day in economic history, President Richard Nixon delivered the Nixon Shock, a decision that would reshape the global financial landscape. Faced with mounting inflation and the prospect of a gold run, Nixon’s administration made the audacious move of suspending the convertibility of the US dollar to gold. This act not only terminated the Bretton Woods Agreement but also initiated a series of economic policies that sought to prioritize domestic growth and exchange rate stability.

The Nixon Shock fundamentally altered the international monetary system by decoupling currencies from physical assets like gold. This policy shift opened the door to the fiat currency era, where governments could print money without the constraint of physical reserves. The shockwaves of this decision reverberated across economies and had far-reaching consequences.

Enter Bitcoin: A Digital Response to Fiat Vulnerabilities

Fast forward to today, where once again, concerns about fiat currency stability are at the forefront. Inflationary pressures are mounting, and traditional financial systems are grappling with their limitations. This is where the echo of the Nixon Shock intersects with the rise of cryptocurrencies, notably Bitcoin.

Bitcoin, often hailed as “digital gold,” presents a counterpoint to the vulnerabilities exposed by the Nixon Shock. Its decentralized nature and limited supply mechanism stand as a stark contrast to the fiat money printing that has become commonplace. Just as the Nixon Shock signaled a departure from the gold standard, Bitcoin embodies a departure from centralized currency control.

A Parallel Journey: Past Lessons for the Future

The Nixon Shock’s legacy was complex. It led to the end of the Bretton Woods System, paved the way for fiat currencies, and raised debates about monetary policy that continue to this day. Similarly, Bitcoin’s emergence has sparked discussions about the future of money, the role of central banks, and the potential for a decentralized financial revolution.

As economists continue to analyze the long-term impact of Nixon’s decisions, we find ourselves at the crossroads of history once more. Cryptocurrencies like Bitcoin are causing us to reevaluate fundamental aspects of our financial systems. They challenge us to reconsider how we store and exchange value, much like the Nixon Shock did over half a century ago.

In essence, the Nixon Shock and the current cryptocurrency movement both highlight the fluid nature of monetary paradigms. The lessons of the past invite us to critically examine the evolution of money and its role in our ever-changing world. As we navigate this dynamic landscape, history serves as a guide, reminding us that paradigm shifts can reshape economies and societies for generations to come.

#NixonShockRedux #BitcoinRevolution #FinancialInnovation

#NixonShockRedux #BitcoinRevolution #FinancialInnovation