The team behind Blockminer has just dropped a new piece into the puzzle with the launch of its Automated Liquidity Program, or ALP. It’s not dressed in glitter or inflated promises, but it’s quietly shifting how liquidity, mining, and rewards might play together. The idea sounds technical—and it is—but at its core, it’s trying to give life to an overlooked question: who gets rewarded, and how, when people bring liquidity to a project?

ALP is being framed as a fresher take on bonding curves, a model used widely across decentralised finance to control how token prices change based on supply and demand. The bonding curve was meant to smoothen the messiness of early token economics, but it hasn’t aged well for everyone. It can be rigid, it can be gamed, and it rarely leaves much room for ongoing engagement from liquidity providers after the initial rush. ALP walks into that gap.

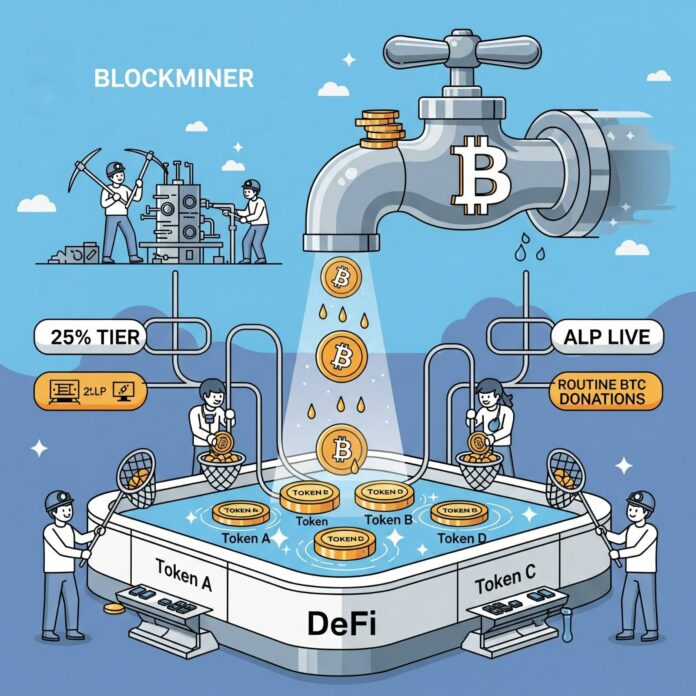

Instead of setting price formulas based on early hype, ALP uses real mining activity to funnel routine bitcoin donations directly to those who’ve provided liquidity. It’s as if your wallet got topped up every time someone mined more of a token you support—small, regular nudges that keep you in the loop and in the rewards stream. Blockminer calls it routine, but routine here feels like a feature, not a flaw.

Here’s where the numbers start doing the talking. Up to 65% of mining activity gets cycled back into liquidity pools in the form of bitcoin. That means if you’re sitting in one of those pools, you’re not just holding tokens and hoping for market momentum—you’re getting tangible value from network activity. Those satoshis aren’t promises; they’re deposits.

At the moment, four tokens on Blockminer have made it into ALP’s first tier. These are operating at 25%, meaning a quarter of mining costs are being directed into the pool. It’s a conservative start, but one that signals structure. As more tokens launch through Blockminer’s upcoming token launchpad, they’ll also qualify—provided they’ve got a pool on Richswap, the associated decentralised exchange.

For now, tracking token status in ALP isn’t plug-and-play. The team is in the middle of overhauling their website to make it easier for users to see what tier a token’s in, how much has been donated, and what’s flowing where. Until that’s in place, the updates are coming from the CEO’s tweets, which is both quaint and oddly human in the context of mining and liquidity bots.

There’s also a strategic rhythm at play here. ALP doesn’t reinvent mining or liquidity—it just rewires the flow. Miners still mine. Liquidity providers still provide. What’s changed is the bridge between the two. Now, if you’re a miner who needs to convert your rewards to keep operations going, you’ll find deeper liquidity pools waiting. If you’re a liquidity provider wondering what’s in it for you, the bitcoin donations offer a kind of dividend.

It’s a loop, not a line. And that matters. Too often, token incentives get handed out in bursts—early bonuses, staking multipliers, bonus airdrops—followed by long stretches of silence. ALP’s model feels less like a giveaway and more like a contract. Stay in the pool, keep the liquidity, and the system gives you your share, bit by bit. It’s not flashy. But for people trying to build consistent positions over time, it might just be attractive.

The choice to use bitcoin as the donation currency rather than a platform-native token is another subtle twist. Bitcoin has weight. It has recognition. And it doesn’t need an explainer. There’s a kind of simplicity in saying, “You earn bitcoin every time someone mines the token you’re supporting.” That lands differently than saying, “You get an extra governance token that might be worth something if we list on another DEX in six months.”

Of course, the effectiveness of ALP is going to depend on volume. More miners, more donations. More tokens, more tiers. And that means Blockminer will need to keep momentum without losing clarity. It’s walking the tightrope between encouraging participation and maintaining control over the mechanics.

There’s an honesty to ALP that feels refreshing. It’s not pretending to solve every liquidity issue. It’s not aiming to pump token prices. It’s just aiming to reward people for being part of the process, using existing mechanisms in a slightly smarter way. Whether it succeeds will depend on how users respond, how mining activity scales, and how efficiently those bitcoin donations are distributed. But the fundamentals are there.

This isn’t a call for mass adoption. It’s a move aimed at a very specific corner of the crypto crowd—those who provide liquidity, those who mine, and those who track token flow as if it were weather data. The rest of the crowd may not even notice what’s happening under the hood. But for the ones who do, ALP might be the difference between a pool that stays alive and one that quietly dries out.

There’s something slightly old-school in Blockminer’s tone, too. The focus on proof-of-work over trendier consensus methods like proof-of-stake feels deliberate. PoW isn’t the darling of the DeFi scene anymore, but it carries with it a certain transparency. You can see it, measure it, and link effort directly to reward. Pairing that with ALP builds a kind of token distribution ecosystem that feels earn-your-keep rather than click-and-claim.

That said, ALP isn’t framed as a replacement for bonding curves. It’s described as better. Not perfect. Not radical. Just better. And that restraint is part of what makes it feel worth watching. Crypto has plenty of big promises. Quiet execution tends to last longer.

As ALP rolls out and the token launchpad goes live, there’ll be more to assess—more tiers, more metrics, more movement. For now, what exists is a structure that rewards users with bitcoin for keeping systems liquid and stable. That might not make headlines every day, but it could change how liquidity is perceived and sustained.

Liquidity is often the underpaid worker of DeFi. Without it, everything else stalls. ALP turns it into a paid position—one that doesn’t depend on a bull run or a token unlock event. It depends on activity, participation, and a system that rewards people for showing up, again and again.

It might not spark fireworks, but it could light a few signal lamps for people paying attention. And that might be enough to make it stick.