A new token has arrived on the Internet Computer, and it’s already drawing eyes. cICP, launched by the Neutrinite DAO, is a liquid staking asset that aims to offer more than passive rewards—it brings automatic compounding, strategic trading, and a deflationary approach to ICP.

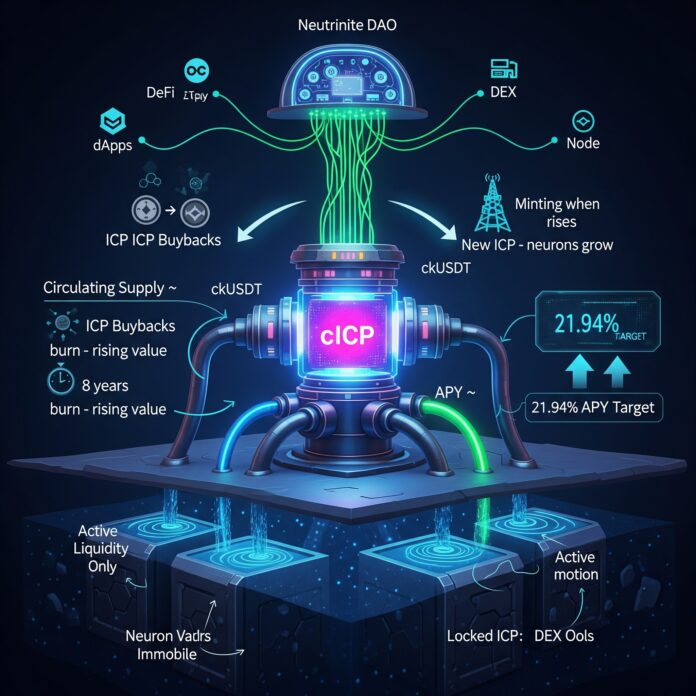

The cICP staking structure puts 90% of deposited ICP into eight-year neurons, the longest commitment period on the IC, while the remaining 10% gets converted to ckUSDT over time to fund node setup. The system uses both staking mechanisms currently available on the Internet Computer, and that mix is where things get interesting. Daily neuron maturity is automatically used to buy cICP, and then burned, reducing supply and potentially boosting the asset’s value over time.

That compounding system becomes more effective when liquidity is low compared to the mint rate, leading to higher annual percentage yields. On the flip side, if the exchange rate goes above the mint price, cICP mints more tokens and uses buybacks to direct more ICP into neurons—an approach designed to keep the token’s price stable and its staking base strong.

The staking design also factors in on-chain trading strategies. A portion of yield gets routed toward active trading methods to push APYs higher and reward liquidity providers. Around 30% of all total value locked is expected to go into cICP pools with other coins, aiming to drive volume and anchor cICP as a major DeFi token.

There’s also a focus on security and decentralisation. Most of the ICP behind cICP is locked into neurons, which means it’s immovable—only the daily staking yield is active. Liquidity is deliberately spread across decentralised exchanges to reduce risk. If a DEX is compromised, only the funds in that DEX are affected. Contracts are under the control of the Neutrinite DAO. Even if the minter is exploited and DEX liquidity is wiped out, the token is structured to recover value at the mint price. And hardware attacks? The project doesn’t see that as a viable threat. Node hardware is cheap and not worth enough for it to be a serious target.

Liquidity in this setup doesn’t come from unlocking tokens—it flows from the buyback system or from new users buying cICP. The liquidity in DEX pools shows how much can be pulled from the stream at a given moment, but doesn’t define the token’s real value.

To keep the protocol sustainable, 5% of the buyback stream is converted to Neutrinite’s own NTN token and burned. This helps cover decentralised app maintenance and cycle costs. Nodes contribute too, paying service fees, while the rest of their rewards go back into the buyback stream. The team wants fairness in distribution, with the aim that 1% of the voting power should correspond to 1% of IC nodes.

As for the numbers: staking neurons earn around 14% APR, but with 10% allocated to node acquisition, the base comes down to 12.6%. Nodes are expected to add over 5%, and with potential gains from price fluctuations, total returns may reach beyond 20% APR. Once compounded, the annual yield could land around 21.94%, even after NTN burn fees.

cICP is pushing a deflationary take on ICP. Instead of promising more rewards from inflation, it takes a percentage of both inflationary mechanisms—neuron maturity and node rewards—and rolls them into a single token that aims to increase in value while reducing liquidity access in the short term.

The token is governed by the Neutrinite DAO, which can modify its flow and algorithm to better serve liquid stakers. Voting power currently tracks the Anvil neuron, but once it holds more than 400,000 ICP, cICP holders will be able to follow other neurons of their choice.

The design includes reactive elements based on ICP’s price. If the ICP token drops, node rewards increase to help offset the loss in value. If it rises, arbitrage mechanisms in the ckUSDT–cICP and ICP–cICP pools adjust prices to reflect the gain, automatically increasing APY for cICP holders by simulating sales from those cashing in on the ICP rise.

A few tips are already being shared by early users: using cICP in DCA setups with ckUSDT over time, or creating streams for CycleOps that slowly hydrate canisters over years—setup once and let it run. Meanwhile, arbitrage bots help keep price gaps in check across exchanges, converting volume into trading fees and keeping pools healthy.

Retail investors are finally able to tap into both Internet Computer staking methods using cICP with just a few cents. By contrast, running a node requires significant investment in hardware, which made staking via nodes unreachable for most users—until now.

To appreciate what cICP is building, it helps to recall where liquid staking on the Internet Computer began. WaterNeuron’s nICP was the first to offer a way to stake ICP while retaining flexibility. Stake ICP through WaterNeuron, get nICP in return, and use that to participate in DeFi—trading, providing liquidity, or simply holding. When ready, users can unstake their nICP to redeem their ICP, although the neuron’s lockup may introduce some delays. It brought accessibility and movement to an otherwise locked-up process.

cICP now expands that concept with built-in compounding, strategic trading support, a deflationary outlook, and decentralised governance through the Neutrinite DAO. The early staker incentivisation program is scheduled to be announced soon. For a token that just launched, cICP is already trying to reshape how users interact with staking on the Internet Computer, and early participants are watching closely.