Comparisons between various platforms are inevitable. A recent thread on social media sparked an intense debate between proponents of Solana and Ethereum, focusing particularly on metrics like the Nakamoto Coefficient (NC), speed, and scalability. While the thread made some compelling arguments for Solana’s superiority in terms of decentralisation and speed, it also raised questions about other factors like developer network diversity, infrastructure, and token distribution. This article aims to explore these facets in-depth.

The Nakamoto Coefficient: A Measure of Decentralisation

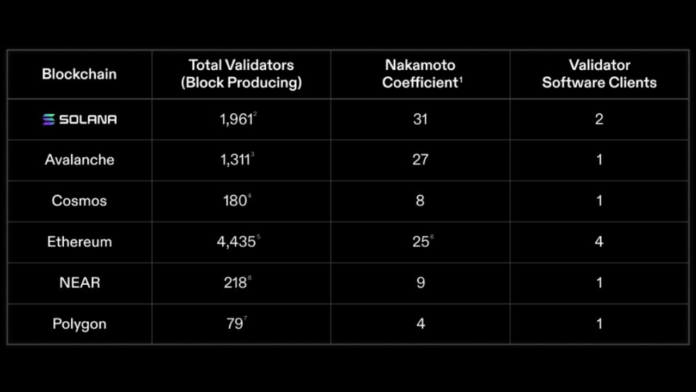

The Nakamoto Coefficient is a term used to evaluate the minimal consensus threshold among nodes or validators that must agree to maintain a blockchain’s functionality. A higher NC value indicates a more decentralised network. According to some reports, Solana outperforms Ethereum when examined through the lens of the Nakamoto Coefficient.

While this could be a significant point in Solana’s favour, it’s crucial to understand that decentralisation isn’t solely about node or validator distribution. It’s a multi-faceted concept that also involves aspects like client diversity, developer participation, and more.

Speed and Scalability: Solana’s Selling Points

Solana has been praised for its transaction speed and scalability, attributes often considered its edge over Ethereum. As the DeFi sector continues to grow, the ability for a network to handle a high volume of transactions quickly is crucial. Solana’s architecture allows for this, making it a compelling option for developers and users seeking faster transaction times and lower fees.

Developer Network and Infrastructure Diversity

Ethereum, being one of the pioneering platforms for smart contracts, has a broad and robust ecosystem. Its developer community is vast, with a variety of applications ranging from decentralised finance (DeFi) to non-fungible tokens (NFTs) and beyond. Solana is relatively new but is catching up quickly.

In terms of infrastructure diversity, both networks have multiple client implementations and are supported by a range of service providers. However, Ethereum has had more time to mature and diversify its infrastructure, providing a more extensive range of options for developers.

Token Distribution: The Gini Coefficient

The Gini coefficient measures inequality in a distribution—a lower value indicates a more equal distribution of resources. While comprehensive data may be lacking, there’s a general perception that Ethereum’s longer history and broader developer and user base have resulted in a more equitable token distribution compared to newer blockchains like Solana.

Cross-Chain Bridge Diversity

The utility of a blockchain extends beyond its own ecosystem. The ability to interact with other networks via cross-chain bridges adds layers of functionality and utility. Ethereum has been a frontrunner in this aspect, but Solana is not far behind with its growing number of cross-chain compatibility features.

The Final Analysis

The Solana vs Ethereum debate is more nuanced than it appears at first glance. While Solana excels in speed, scalability, and by some measures, decentralisation, Ethereum boasts a more diversified developer ecosystem and infrastructure.

Ultimately, both blockchains have their strengths and weaknesses, and the “better” platform may vary depending on individual needs and what one values more in a blockchain. What’s clear, however, is that the comparison between the two is far from straightforward and is a topic that warrants ongoing scrutiny as both ecosystems evolve.