Maria Irene

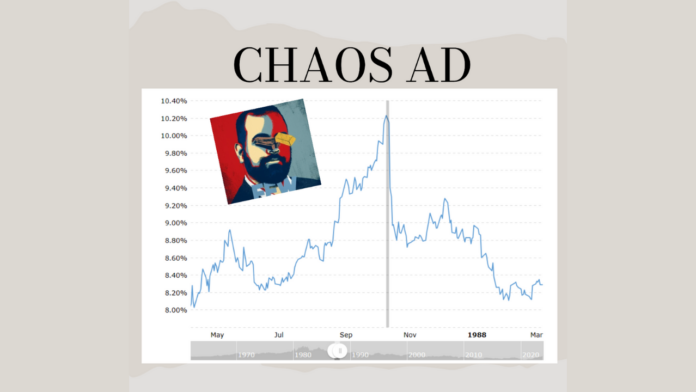

Let’s drill into the data. As of a recent Friday, the 10-year Treasury yield was clocking in at 4.94%, just a hair shy of the psychological 5% barrier. That’s a steep climb from its pandemic low of 0.5% back in 2020. The surge has been driven by expectations of higher interest rates set by the Federal Reserve, strong economic data, and indications that inflation isn’t going anywhere soon. Indeed, this high-yield environment seems to validate the Fed’s hints at a more prolonged high-interest-rate scenario, at least into 2024.

Now, the yield situation isn’t just restricted to the 10-year note. The two-year Treasury note’s yield was at 5.11%, and the 30-year bond yield hit 5.06%. That’s not merely a blip; it’s a trend. As bond yields rise, the impact ripples across the financial landscape, affecting everything from corporate bonds to mortgage-backed securities. It’s also no friend to the stock market; the S&P 500 has seen a 6% dip since August, as bond yields have surged.

So are these sky-high yields a harbinger of doom, as Gayed suggests? Well, the answer isn’t as clear-cut as his tweet might imply.

Firstly, it’s worth considering other factors like oil prices and geopolitics. Traditionally, rising oil prices point to mounting inflationary pressures, which in turn push up bond yields. Then there’s the geopolitics angle. Tensions on the global stage often send investors scurrying to the safety of bonds, which could put a dent in yields. Recent reports suggest that 10-year Treasury and Bund yields could hit new cycle highs of around 5% and 3%, respectively, influenced by ongoing geopolitical situations and broader macroeconomic conditions.

Secondly, let’s acknowledge that financial markets have evolved since 1987. Regulatory frameworks have tightened, and markets have become more sophisticated. Yes, the yields are high, but to draw a direct line between today’s environment and Black Monday would be to overlook the complex financial landscape we now operate in.

Finally, let’s not overlook the key differences between now and 1987. Three decades ago, the economic setting was drastically different, and the financial markets were not as interconnected and complex as they are today.

So, are we really “F$C$ED,” as Gayed asserts? Probably not. But that doesn’t mean it’s all sunshine and rainbows either. The sharp rise in bond yields serves as a wake-up call to investors. While it may not herald a market meltdown, it certainly underlines the need to be vigilant.

It’s a risky gamble to depend solely on historical trends to predict future financial turmoil. And while history doesn’t necessarily repeat itself, it often rhymes. The bond market, often considered the snore-fest of the financial world, has suddenly turned into a thriller. Investors would do well to pay attention, because, like it or not, the numbers don’t lie. It might not be time to hit the panic button, but keeping a finger hovering above it wouldn’t be the worst idea either.