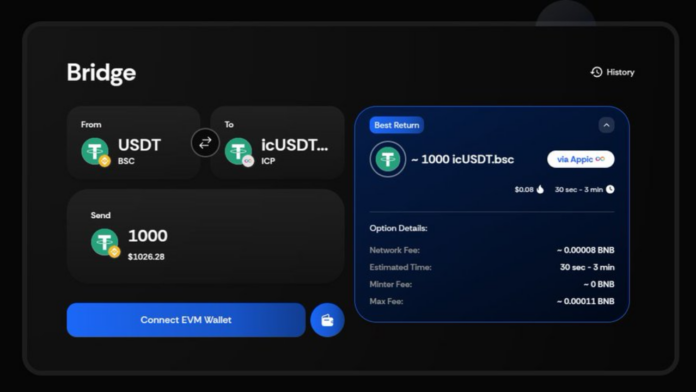

The advancement of interoperability in decentralised technology has taken a significant step forward with the introduction of the Appic Cross-Chain EVM Bridge, which now seamlessly connects BNB Chain to Internet Computer Protocol (ICP). This development enables users to securely bridge popular tokens such as $BNB, $USDT, and $USDC into wrapped tokens on ICP, paving the way for an enhanced cross-chain experience that promises both liquidity and security.

The newly introduced wrapped tokens are icBNB.bsc, icUSDT.bsc, and icUSDC.bsc, and they represent the migration of assets from BNB Chain to ICP. This move is set to unlock new possibilities for decentralised finance (DeFi) users, as it allows assets to flow more freely between two significant ecosystems. With this capability, users will be able to leverage the benefits of ICP’s fast and scalable infrastructure while still holding onto assets in the widely-used BNB Chain ecosystem.

As with any technological advancement, the true value lies in its ability to facilitate new use cases and opportunities. The Appic Cross-Chain EVM Bridge provides the tools for ICP users to engage with popular assets on BNB Chain, which has seen significant growth in recent years. By bridging tokens like $BNB, $USDT, and $USDC into the ICP ecosystem, the bridge creates a pathway for enhanced DeFi activity and the potential for further liquidity opportunities. Users can now interact with these wrapped tokens in a decentralised and secure manner, providing a wider range of trading options.

In a broader context, this development is another sign of the growing need for cross-chain interoperability. Many users and developers have long sought ways to connect different ecosystems to enable asset movement and greater collaboration. While some networks have made progress in this regard, the Appic Cross-Chain EVM Bridge sets a new standard by not only connecting two major systems, but also providing users with access to popular tokens that are traditionally part of different chains.

The integration of wrapped tokens is a key element of this innovation. Wrapped tokens have become a standard feature in the decentralised space, enabling users to bring assets from one network onto another while maintaining their original value. In this case, the wrapped tokens icBNB.bsc, icUSDT.bsc, and icUSDC.bsc will allow users to bring their BNB Chain assets into ICP without the need for complex or risky procedures. The tokens will represent the same value as their underlying counterparts on BNB Chain, ensuring that users retain the full value of their assets when moving them across chains.

For the broader ICP ecosystem, this cross-chain bridge opens up new avenues for liquidity. By proposing the listing of these wrapped tokens on ICPSwap, a decentralised exchange built on ICP, the Appic team is laying the groundwork for new liquidity pools. Once approved, these pools can facilitate trading between wrapped BSC tokens and native ICP assets, adding depth to the market and increasing the range of trading possibilities. This step further enhances the utility of ICP, making it a more attractive platform for DeFi traders looking for diverse asset options.

The potential impact of these wrapped tokens and the liquidity pools they support cannot be overstated. By enabling ICP users to engage with BNB Chain assets, Appic is fostering greater collaboration between two powerful ecosystems. With the liquidity pools that will be created once the tokens are listed on ICPSwap, traders will be able to access more liquidity and have greater flexibility in executing trades. This development is particularly significant in the DeFi space, where liquidity is a vital component of the market’s efficiency and stability.

The introduction of the Appic Cross-Chain EVM Bridge and the listing proposal on ICPSwap also speaks to the growing role of decentralised exchanges in the wider decentralised ecosystem. DEXs have quickly become an essential part of the DeFi landscape, allowing users to trade assets without relying on centralised intermediaries. By connecting wrapped BNB Chain tokens to ICP via a decentralised exchange like ICPSwap, users will be able to trade assets in a secure and trustless manner, maintaining the decentralised ethos that underpins the entire Web3 movement.

The future of interoperability looks bright, with projects like the Appic Cross-Chain EVM Bridge leading the way. As the demand for cross-chain solutions grows, the importance of seamless asset movement between ecosystems will only become more pronounced. The Appic Cross-Chain EVM Bridge is a major step towards making this a reality, and it has the potential to catalyse further innovations in cross-chain functionality.

For developers, the implications of this new bridge are profound. By facilitating the easy movement of tokens between BNB Chain and ICP, developers can now create more sophisticated applications that leverage assets from both ecosystems. This opens the door for new kinds of dApps that take advantage of the unique features of each chain. Whether it’s combining the fast and scalable infrastructure of ICP with the liquidity and established presence of BNB Chain, developers now have the flexibility to create more versatile and powerful applications.

In addition to developers, users will also benefit from the expanded options for trading and investing. The ability to bridge $BNB, $USDT, and $USDC into wrapped tokens on ICP provides users with greater freedom to move their assets between ecosystems while maintaining their value. The creation of liquidity pools on ICPSwap will only enhance this experience, as users will be able to trade these wrapped tokens with other ICP assets. This feature will undoubtedly attract more users to the platform, increasing the overall activity within the ICP ecosystem.

While this is a significant milestone, it’s just the beginning. The Appic team’s vision for cross-chain interoperability is still unfolding, and further developments are expected. As the decentralised space continues to mature, solutions that enable seamless asset movement between ecosystems will become even more essential. The Appic Cross-Chain EVM Bridge sets a strong foundation for future advancements in this area, and its impact on the broader ecosystem will likely be felt for years to come.

The success of the Appic Cross-Chain EVM Bridge is a testament to the growing momentum in the decentralised space towards interoperability and user-centric solutions. By enabling secure, efficient, and seamless bridging of assets between BNB Chain and ICP, the bridge sets a new standard for what’s possible in cross-chain functionality. As the ecosystem grows and more tokens are bridged, the opportunities for users, developers, and projects will only expand.

This development is yet another step in the ongoing transformation of the decentralised space, where decentralised technologies continue to evolve and reshape the way users interact with digital assets. With the Appic Cross-Chain EVM Bridge now connecting BNB Chain and ICP, the possibilities for collaboration and growth are endless, and the future looks promising for those involved in both ecosystems.