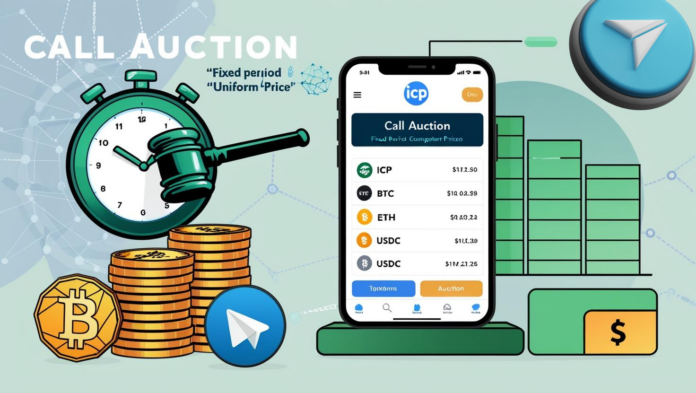

At the core of DailyBid’s offering is a single radical shift: collect trades over a fixed period and execute all of them at the same clearing price. It’s a method borrowed from financial markets but rarely seen in DeFi. This move strips away the unpredictability of split-second fluctuations and the infamous “gotcha” moments that leave average traders nursing losses while bots and whales skim profits. Uniform-price auctions might not sound flashy, but in a world where fractions of a second can tilt outcomes, slowing things down could actually be the smarter way forward.

DailyBid doesn’t hide its distaste for traditional decentralised exchanges. Most, it argues, only look fair until you’re in the middle of a trade and see your price slip away, or watch as someone jumps the queue with a bigger bag. The front-running problem—where bots spot your intent and get ahead of your trade to exploit the price movement—is especially damaging for small traders. Slippage, the difference between the expected price and the actual execution, compounds this frustration. DailyBid’s setup eliminates both, making it less of a gamble and more of a marketplace.

This isn’t just another clever bit of marketing. Everything on DailyBid is fully on-chain. No off-chain order books. No centralised backend holding things together quietly in the shadows. Every bid and every execution is out in the open, recorded permanently and governed by code alone. Traders don’t have to trust DailyBid because there’s no person or entity pulling strings—just smart contracts doing what they’re told.

The platform’s trustless design is matched by its expanding trade offerings. Traders can currently swap ICP, BTC, ETH, USDC, EURC, OGY, GLDT, and TCYCLES, all paired against USDT. It’s a lineup that includes not just mainstream coins but also some of the Internet Computer’s own ecosystem tokens, providing liquidity for communities that often find themselves overlooked by more Ethereum-centric DEXs.

Depositing to DailyBid is designed to be just as streamlined. The platform works with ICRC-1 wallets—like Oisy or the native NNS—allowing users to send their tokens directly to their wallet address on DailyBid and then click ‘Claim Deposit’ to finalise the transaction. There’s no middleman, no waiting for confirmations across bridges or centralised custody services. Just fast, clean execution.

And for those glued to Telegram, the DailyBid Stats Bot offers a particularly sharp tool. It’s a live price-tracking service for coins like ICP, BTC, and others, delivering up-to-the-second prices in a minimal format. Traders can simply type commands like /stats ICP and receive clean price feeds without any extra noise. The bot is not just an add-on—it’s integrated into how traders on DailyBid keep up with the market, forming a bridge between chat and execution. The ability to trade or track movement directly from Telegram makes DailyBid as fast as the group chat, appealing to the kind of trader who wants less dashboard and more direct action.

It’s no accident that DailyBid is built on ICP. While Ethereum dominates DeFi, the Internet Computer offers something Ethereum can’t: an entirely on-chain stack, including the frontend. This means there’s no hidden AWS instance running the user interface, no off-chain database storing sensitive inputs. Everything, from the code that handles trades to the interface that users interact with, is baked into the blockchain. That’s rare. And in a time when decentralisation is often marketed harder than it’s implemented, it’s an important distinction.

The platform’s call auction model isn’t new to traditional finance, but its use in DeFi at this scale is certainly unusual. By collecting orders over a fixed time and executing them all at once, DailyBid ensures fairness, but it also brings predictability to price discovery. Instead of watching prices fluctuate wildly between clicks, traders can enter knowing they’ll either get the market-clearing price or nothing at all. This shifts the game from speed to strategy, which could encourage more thoughtful trading behaviour.

There’s a sense of defiance in how DailyBid positions itself. Where most platforms chase volume with gimmicks or reward schemes, this one is quietly focusing on mechanical fairness. It’s not trying to dazzle with token incentives or flashy partnerships. It’s focused on solving three core issues that have haunted DEX users for years: slippage, front-running, and off-chain dependencies. Each of those points may seem technical, but to the average DeFi user, they often spell the difference between trust and exit.

By giving every trader the same price, DailyBid is trying to rewire the incentives. The whales don’t get ahead just because they’re bigger. Bots can’t sniff out retail intent and profit off it. And with all logic executed on-chain, the playing field isn’t tilted based on who’s closer to a server or who figured out the latest exploit. It’s just code doing what it’s meant to do, for anyone who shows up.

While it’s still early days, the platform’s clean integration with Telegram and its no-nonsense approach to execution make it a curious outlier in a space known for bells and whistles. It’s not trying to reinvent finance—it’s simply offering a place to trade that doesn’t feel like a race or a trap. Whether it’s enough to gain ground in a crowded DEX market remains to be seen, but the intent is clear: fairness shouldn’t be a premium feature.