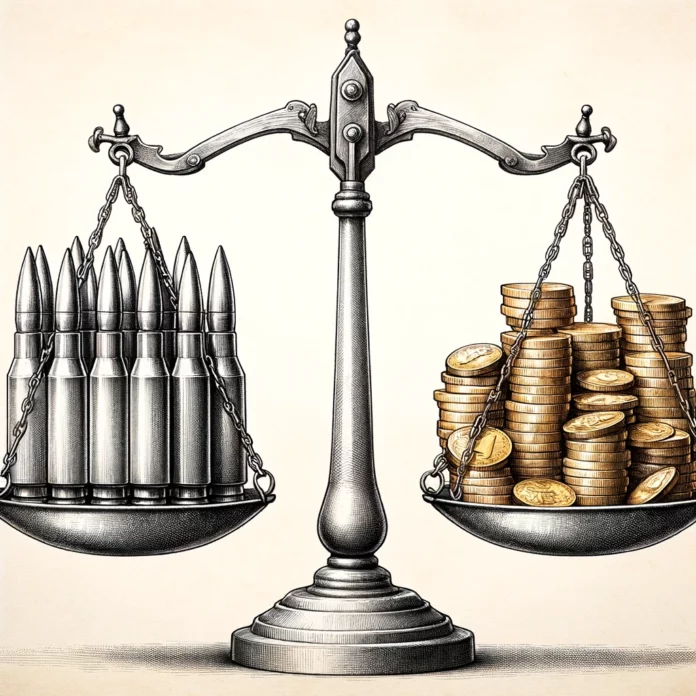

Wars are seismic events that shake the very foundations of nations. Yet, despite their devastation and human cost, their impact on financial markets can be surprisingly counterintuitive. A look back over the past century provides some fascinating insights into how stocks, bonds, and other financial instruments react to the drums of war.

When Archduke Ferdinand was assassinated in 1914, the shockwave reverberated not just across political boundaries but also in financial centres. The New York Stock Exchange closed its doors for four months as tensions soared. Yet, when trading resumed, American stocks rallied dramatically. The Dow Jones Industrial Average, which had traded at 60% of its January 1913 level, more than doubled by the end of November 1916. Similarly, during World War II, the Dow gained almost 50% from the beginning to the end of the war, averaging a 7% per year increase.

As we move to the era of the Vietnam War, it’s intriguing to note that between 1965 and 1973, U.S. stock markets increased by 43%, or about 5% annually. This was despite significant public protests and divisions within the country. In the heat of the Persian Gulf War, financial markets wobbled significantly as Saddam Hussein’s army overran Kuwait’s oil fields and menaced Saudi Arabia. Yet, fast-forward to the Iraq War, and we find that U.S. stock markets reached record highs, partly fuelled by a period of high global growth.

The Korean War tells its own tale. Despite an initial drop in the Dow Jones of around 5% on the first day, by the time an armistice was declared in 1953, the Dow was up almost 60%. This almost mirrors what we’ve seen in general trends: the S&P 500 usually takes a hit of about 5% during major geopolitical events but has historically rebounded these losses in fewer than 50 calendar days. In fact, the average S&P 500 performance post-war events has shown progressive gains, rising 1.3% after one month, 2.1% after three months, 5.5% after six months, and 8.6% after a year.

So, what happens to interest rates, foreign exchange, and commodity prices when wars erupt? Generally, the risk of war leads to a decline in Treasury yields and equity prices, a broadening of lower-grade corporate spreads, and a dip in the dollar. However, one asset that typically rises is oil. With wars often centred in oil-rich regions, it’s not surprising that this commodity often sees a price spike during times of military conflict.

Curiously, despite the turbulence and unpredictability of wartime, stocks have historically been less volatile during these periods. Furthermore, small-cap stocks have generally outperformed large-cap ones. The rationale for this could be myriad. Whether it’s a case of small firms being more agile and adaptive or benefiting from war contracts, the data suggests that small caps are generally more resilient.

Finally, the economic context in which a war occurs can be a deciding factor in market performance. If a war unfolds against the backdrop of a robust economy, stocks have a tendency to recover and flourish. However, if a war coincides with an economic downturn, the adverse impact on market performance can be far more pronounced.

All said, the impact of war on financial markets is not straightforward. It’s a complex web of factors, interwoven with the fabric of global politics, economics, and social dynamics. Yet, the financial markets have, more often than not, displayed remarkable resilience and adaptability in the face of warfare, making them not just an indicator of economic health but also a reflection of human ingenuity and the will to persevere.