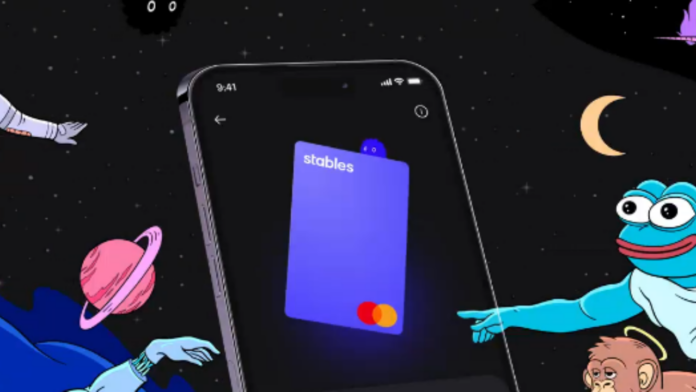

Australian startup Stables has set its sights on Europe in a groundbreaking partnership with Mastercard, signaling a significant milestone in the integration of dollar-pegged assets into mainstream financial systems. Founded in 2021, Stables has rapidly carved out a niche in the crypto payments sector, enabling users to seamlessly transact with USDC (USD Coin) via a digital debit card accepted anywhere Mastercard is welcomed.

In an exclusive interview with Cointelegraph, co-founder Bernado Bilotta highlighted the strategic importance of this expansion, emphasizing that it opens up a market nearly twenty times the size of their native Australia. This move, made possible through collaboration with Mastercard, promises to empower users across 27 European countries, facilitating transactions through familiar platforms such as Apple and Google Pay.

Stablecoins, traditionally associated with the volatile world of cryptocurrencies, are now gaining traction beyond the realm of crypto enthusiasts. Bilotta noted that these assets are increasingly adopted by everyday consumers seeking stability and reliability in their financial transactions. Described by Morgan Stanley as “crypto’s killer app,” stablecoins have transcended their origins in niche markets to become a trusted tool for trading, remittances, and cross-border payments worldwide.

“The irony,” Bilotta remarked, “is that stablecoins, designed for stability, have found the strongest product-market fit in a landscape notorious for its volatility.” This adaptability has attracted users from regions facing economic instability, such as Argentina and Turkey, as well as areas plagued by currency fragmentation, like Southeast Asia.

Stables’ journey to European markets underscores Australia’s role as a fertile ground for crypto innovation. Despite regulatory ambiguities, which have prompted concerns from other industry players, Bilotta views Australia as an advantageous “sandbox” for developing and exporting crypto solutions. He cited the country’s stringent financial regulations as a competitive advantage, enabling Stables to operate with confidence and compliance.

Since its inception, Stables has garnered support from prominent figures in the fintech and crypto sectors, including Jump Capital and Pocketbook co-founder Alvin Singh. The startup’s recent collaboration with Mastercard to introduce euro support further solidifies its position as a pioneer in the stablecoin space.

Looking ahead, Bilotta remains optimistic about the future of stablecoins, predicting continued growth and adoption as they become integral to global payment systems. With innovations like the integration of USDC across Europe, facilitated by industry giants like Mastercard, Stables is poised to lead the charge in making stablecoin payments accessible and practical for consumers worldwide.