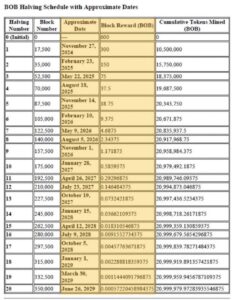

BOB’s latest halving has officially taken place, cutting block rewards from 300 BOB to 150 BOB. With 35,011 blocks already mined and 24,516 miners contributing to the network, the event marks a shift in supply dynamics that many have been anticipating. The reduction in mining rewards is a key milestone, shaping how participants interact with the network and setting the stage for future adjustments. The next halving, expected at the end of May, will see block rewards drop further to 75 BOB, reinforcing the gradual tightening of supply.

Launched in September 2024, BOB replicates Bitcoin’s consensus mechanism while leveraging ICP’s scalable infrastructure. This integration allows users to deploy smart contracts, known as canisters, to participate in mining by solving cryptographic challenges. The project has garnered significant attention within the ICP community, contributing to increased network activity and transaction volumes.

Miners and market watchers alike have been closely following this event, knowing that halvings play a crucial role in adjusting incentives and ensuring long-term sustainability. With fewer rewards available per block, competition intensifies, pushing miners to optimise operations and assess profitability. This shift often triggers adjustments in hash power distribution as miners evaluate costs against potential returns.

Total active miners currently stand at 24,516, demonstrating a strong commitment to maintaining network security despite the reduced incentives. The current block, however, has no active miners at the moment, a temporary lull that is not uncommon in the immediate aftermath of such changes. Network participation often experiences fluctuations following a halving, as miners recalibrate and adapt to the new reward structure.

BOB’s price sits at $1.2242, a figure that may experience shifts as the market digests the halving and its implications. While short-term volatility is expected, historical trends suggest that halvings tend to influence price movements over time. With the supply rate slowing down, some anticipate long-term appreciation, while others remain cautious, keeping an eye on broader market conditions.

The countdown to the next halving is already underway, with 17,489 blocks remaining before the next scheduled reduction. By the end of May, block rewards will drop to 75 BOB, further shaping mining dynamics and influencing network participation. The steady decrease in rewards ensures that new supply enters circulation at a diminishing rate, a mechanism designed to introduce scarcity and sustain value over time.

Mining remains a cornerstone of network security, and as rewards decrease, efficiency becomes even more critical. Miners must weigh electricity costs, hardware performance, and overall operational expenses against potential earnings. Some may choose to upgrade equipment or seek locations with lower energy costs, while others may opt to scale down or exit if profitability becomes unsustainable. These decisions collectively influence the distribution of hash power and the resilience of the network.

Beyond miners, investors and traders are also assessing the impact of the halving. Supply reductions tend to attract attention, especially when combined with broader market trends. If demand remains steady or increases, the reduced issuance of new BOB could contribute to price appreciation. However, market sentiment, liquidity, and macroeconomic factors all play roles in shaping outcomes, making it difficult to predict movements with certainty.

Halvings introduce a natural rhythm to supply adjustments, creating periodic moments of recalibration. This built-in mechanism ensures that issuance gradually tapers off, preventing excessive inflation and reinforcing long-term stability. Each halving event brings a mix of anticipation and speculation, as stakeholders analyse past trends while preparing for potential shifts.

With the latest halving now complete, attention turns to network health and miner response. The initial period following a reward reduction often sees adjustments in mining activity, with some participants adapting and others reconsidering their positions. As efficiency becomes paramount, innovations in mining technology and operational strategies may emerge, shaping the landscape in the months ahead.

The broader implications of the halving extend beyond immediate network adjustments. As supply issuance slows, the economic model underpinning BOB evolves, influencing everything from miner incentives to market perception. The long-term sustainability of the network depends on balancing these shifts, ensuring that security remains robust while maintaining an environment conducive to participation.

As the next halving approaches, the focus will remain on network performance, market response, and miner activity. The evolving landscape offers both challenges and opportunities, with each participant navigating the shifting dynamics in their own way. While the exact outcomes remain uncertain, one thing is clear—the gradual reduction in rewards is an integral part of the system’s design, shaping its future with each passing block.